Helping you find

tax information & services

Learn About eTIMS

Tutorials & Guides

How to Register for eTIMS on the eCitizen Web Solution (ecitizen.kra.go.ke)

How to Create an eTIMS Invoice on the eCitizen Web Solution (ecitizen.kra.go.ke)

How to Create an eTIMS Invoice on the eTIMS Online Solution (etims.kra.go.ke)

How to create an eTIMS Invoice on the eTIMS Client Solution

How to raise a credit note on the eTIMS Online Solution (etims.kra.go.ke)

How to raise a credit note on the eTIMS Client Solution (etims.kra.go.ke)

How to raise a credit note on the eTIMS eCitizen Web Solution (ecitizen.kra.go.ke)

How to Sign Up and Create a Service Request - eTIMS Online Solution (etims.kra.go.ke)

eTIMS Fuel Station System

Overview

The Kenya Revenue Authority (KRA) continues to champion the modernization of tax administration by rolling out the eTIMS Fuel Station System, a tailored extension of the existing eTIMS solutions.

The petroleum sector, known for its complex and high-volume operations, was significantly impacted by the electronic invoicing requirement that mandates a compliant e-invoice for every sale. Traditional ETRs often posed operational challenges, resulting in non-compliance and inefficiencies in fuel dispensing environments.

The eTIMS Fuel Station System was introduced to address these gaps. Implementation began in June 2024 and follows a 12-month phased rollout, including a voluntary pilot and extensive stakeholder engagements ahead of the mandatory compliance deadline.

1. Objectives of the eTIMS Fuel Station System

This system enables fuel stations to meet real-time electronic invoicing requirements while ensuring compliance, accuracy, and operational efficiency in a fast-paced retail environment. It also aims to reduce manual errors and simplify tax filing through system automation.

2. Key Benefits for Fuel Stations

- Automation enhances efficiency and eliminates manual processes.

- Faster service delivery improves customer experience at the forecourt.

- Supports PIN capture, mobile payments, and loyalty programs for seamless integration.

- Improves invoice accuracy and simplifies reconciliation.

- Feeds directly into simplified VAT returns for easier compliance.

- Enables real-time validation for quicker supplier payments and VAT refunds.

3. How the System Works

eTIMS integrates with the fuel station’s automation setup—forecourt controller, sales system, POS, printer, or fuel management system—to ensure that all transactions are recorded and transmitted to KRA in real time. The system supports offline invoicing, VAT auto-fill, mobile money, and loyalty programs, enhancing both compliance and customer convenience.

4. Is the System Mandatory?

Yes. All fuel stations must integrate with eTIMS by 30th June 2025. Failure to comply may result in penalties or enforcement actions. Support is available to assist stations in a seamless migration.

5. Integration Options

- Self-Integration: For stations with internal IT capacity.

- Third-Party Integration: For those requiring external certified integrators.

6. Cost of Integration

Costs vary depending on system complexity, level of automation, and integration method. Certified integrators can provide tailored estimates.

7. How to Get a Certified Integrator

You can access the list of approved eTIMS third-party integrators via the following link:

8. Where to Get Support

KRA offers training, technical support, and advisory through the integration journey.

- Phone: +254 711 099 999

- Email: timsupport@kra.go.ke

- Offices: eTIMS Ops, 7th–8th Floor, JKUAT Towers Nairobi, or any KRA office nationwide.

eTIMS System to System Integration

This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS. System-to-system integration between KRA and the taxpayer's invoicing systems has been provisioned via an Application Programming Interface (API). This can be achieved in two ways;

- Virtual Sales Control Unit (VSCU) – this solution allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers undertaking bulk invoicing and is not always online.

- Online Sales Control Unit (OSCU) - this solution also allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers whose invoicing is always online.

How to Become a Certified 3rd Party Integrator

The process will entail the development, testing, vetting, and certification of either the interested taxpayer who has the capacity to self-integrate or for 3rd party software developers (integrators) to facilitate the taxpayer integration process.

Taxpayers can choose to initiate the self-integration process or enlist the services of KRA-verified third-party integrators.

The links below provide information on the integration process and specification documentation to commence the testing process:

- OSCU Specification document

- VSCU Specification document

- Step by step guide on how to register in sandbox

- Technical Specification for the Trader Invoicing System

- Sandbox test environment

Under the taxpayer portal (etims.kra.go.ke), you will find more information on the system to system including the bio data and required documents as a third party vendor .

Buyer Initiated Invoicing

All persons engaged in business are required to on-board eTIMS and issue electronic tax invoices. However, where the supply is received from a small business enterprise (whose annual turnover does not exceed five million shillings), the purchaser shall issue a tax invoice on their behalf.

Buyer initiated invoicing is available to all on the eCitizen platform (ecitizen.kra.go.ke). The buyer provides the transactional information required i.e. (ID No, Name, Mobile number, description of supply, unit price, quantity & total invoice amount). The seller is required to give consent once the invoice is raised by the buyer. Consent can be provided via USSD option (*222#) or by logging into ecitizen.kra.go.ke

The reverse invoicing solution is purely system based and requires a system-to-system integration with eTIMS. This option is limited to taxpayers whose transactional information is accessed from a trusted billing system where the various players operating within that system are well defined and are sharing records of transactions.

USSD Consent Step by Step Guide - Buyer Initiated Invoicing - This is for Sellers

User Manual for eTIMS Buyer Initiated Invoicing - This is for Buyers

eTIMS Contact and Support Details

|

Contact Details: |

+254 (0711) 099 999 |

|

Email: |

|

|

Location: |

TIMS Operations Unit 7th and 8th Floor, JKUAT Towers – Kenyatta Avenue |

Ready to Use and Install eTIMS?

Download and install eTIMS using any of the links below based on the device applicable to you.

- eTIMS Online portal. Tooltip text

- eTIMS Paypoint (Windows) - Tooltip text

- eTIMS Paypoint (Android) - Tooltip text

- eTIMS Multi Paypoint (Windows) Tooltip text

User guides for eTIMS

- eTIMS Online Portal User guide

- eTIMS PayPoint User Guide (Windows)

- eTIMS Paypoint User Guide (Android)

- USSD (*222#) User Guide

- eCitizen Web User Guide

- eTIMS Multi-Paypoint User Guide (Windows)

Updating eTIMS client on your Device?

Step by Step Guide on Updating eTIMS client

How to Onboard on eTIMS

Taxpayers have been facilitated to self-on-board on eTIMS by eliminating the requirement for intervention from KRA in the approval of applications (service requests). Prior to installing any eTIMS Solution you are required to register for eTIMS by providing details regarding the nature of your business. A step by step guide for eTIMS registration has been provided for your use.

Procedure for eTIMS RegistrationOnce registered, here's how you onboard on the various solutions:

Step by Step on How to Onboard via the Online Portal

Online Portal Step by Step GuideeTIMS Lite

KRA has provided simplified solutions referred to as eTIMS Lite tailor made for the small and micro taxpayers not registered for VAT (non-VAT taxpayers). The eTIMS Lite solutions facilitate the non VAT registered taxpayers to be able to onboard eTIMS and generate electronic invoices. The eTIMS Lite solutions include:

1. eTIMS Lite Web accessible via eCitizen

2. eTIMS Lite USSD accessible by dialing *222# (KRA Services)

3. eTIMS Lite Mobile App accessible on Play Store and Apple Store as eTIMS Non VAT

How to Onboard via eCitizen

Onboarding via eCitizenHow to Generate Invoices via eCitizen (web) and USSD (*222#)

Types of eTIMS Solutions

What are the Solutions available on eTIMS?

In order to improve the user experience, eTIMS has been updated to enable taxpayers to register on more than one eTIMS solution in order to simultaneously generate invoices at their convenience. This has eliminated the need for KRA approval to facilitate change of solution or devices. However, for change of device under the same solution (eTIMS Client) one will require to be facilitated by KRA.

Taxpayers can access all invoices generated from the different eTIMS solutions, such as eTIMS Client, VSCU, OSCU, and eCitizen portal, through the online taxpayer portal (etims.kra.go.ke). Each solution will have its own unique invoice number sequence. However, credit notes can only be generated from the solution where the original invoice was raised.

The solutions available include:

- Online Portal – a web-based platform for invoicing accessible via etims.kra.go.ke

- eTIMS Client – a downloadable software that supports multiple branches and cashier tills/pay points. The software can be configured for both Windows and android devices, i.e. Windows based computers & laptops, android smart phones, tablets & Personal Digital Assistant (PDA) devices

- eTIMS Lite (Web) – a web-based solution accessible through eCitizen.

- eTIMS Lite (USSD) – accessed through the short code *222#. This solution is for individuals and sole proprietors.

- eTIMS Lite (Mobile app) – accessible on Play Store and Apple Store.

- eTIMS System to System Integration – This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS i.e. Virtual Sales Control Unit (VSCU) and Online Sales Control Unit (OSCU).

- Reverse Invoicing and Buyer Initiated Solution – both solutions enable the buyer to generate a tax invoice on behalf of a seller.

Each solution will have its own unique invoice number sequence. However, credit notes can only be generated from the solution where the original invoice was raised.

What is eTIMS?

Simplicity, Convenience and Flexibility

eTIMS (electronic Tax Invoice Management System) is a software solution that provides taxpayers with options for a simple, convenient and flexible approach to electronic invoicing.

Taxpayers can access eTIMS on various computing devices, including computers, laptops, tablets, smartphones, and Personal Digital Assistants (PDAs).

Who Should Use eTIMS?

All persons engaged in business are required to on-board eTIMS and issue electronic tax invoices. However, where the supply is received from a small business enterprise (whose annual turnover does not exceed five million shillings), the purchaser shall issue a tax invoice on their behalf.

Persons in business include:

- Companies, partnerships, sole proprietorships, associations, trusts etc.

- Persons with income tax obligations including:

– Monthly Rental Income (MRI) Tax– Turnover Over Tax (TOT)– Annual Income Tax – for Corporations, Partnerships and Individuals, both resident and non-residents with a permanent establishment.

- Persons conducting business in various sectors, including the informal sector.

- Persons in business whether or not registered for VAT. Persons in business but not required to register for VAT e.g. persons supplying VAT exempt goods and services such as hospitals supplying medical services, schools supplying education services, tours and travel agents, NGO’s in business etc are also required to on-board on eTIMS.

Why is it not just for VAT registered taxpayers?

The law requires that for any person to claim their business expense, the expense must be supported by an electronic tax invoice as at 1st January 2024. Therefore, ALL persons engaged in business are required to issue electronic tax invoices.

Where the seller is a small business or a small-scale farmer, (whose annual turnover does not exceed five million shillings), the purchaser shall issue a tax invoice on behalf of the seller for purposes of claiming that purchase as a business expense. KRA has availed the Buyer Initiated Invoicing Solution to facilitate this process. This solution is accessible on the eCitizen platform

Why eTIMS?

- It aids in reducing compliance costs as the solutions are provided free of charge;

- eTIMS offers flexibility in the solutions available and is accessible on various computing devices;

- The stock management module assists taxpayers maintain their own inventory;

- eTIMS allows taxpayers to a maintain record of invoices issued on the taxpayer portal;

- eTIMS facilitates simplified return filing for taxpayers.

What Business Expenses are excluded from eTIMS?

The following valid business costs have been excluded from the requirement of being supported by an eTIMS invoice:

- emoluments (salaries & wages)

- imports

- air passenger ticketing

- investment allowances

- interest

- fees charged by financial institutions

- expenses subject to withholding tax that is a final tax

- services provided by a non-resident person without a permanent establishment in Kenya

eTIMS - Simplicity, Convenience and Flexibility

Simplicity, Convenience and Flexibility

What is eTIMS?

eTIMS (electronic Tax Invoice Management System) is a software solution that provides taxpayers with options for a simple, convenient and flexible approach to electronic invoicing.

Taxpayers can access eTIMS on various computing devices, including computers, laptops, tablets, smartphones, and Personal Digital Assistants (PDAs).

Who should use eTIMS?

All persons engaged in business are required to on-board eTIMS and issue electronic tax invoices.

Why is it not just for VAT registered taxpayers?

The law requires that for any person to claim their business expense, the expense must be supported by an electronic tax invoice. Therefore, all persons engaged in business are required to issue electronic tax invoices, whether registered for VAT or not (non-VAT taxpayers).

Why eTIMS?

-

It aids in reducing compliance costs as the solutions are provided free of charge;

-

eTIMS offers flexibility in the solutions available and is accessible on various computing devices;

-

The stock management module assists taxpayers maintain their own inventory;

-

eTIMS allows taxpayers to a maintain record of invoices issued on the taxpayer portal;

-

eTIMS facilitates simplified return filing for taxpayers.

What are the solutions available on eTIMS?

The solutions available include:

- Online Portal- Tailored for taxpayers in the service sector exclusively, where no goods are supplied.

- eTIMS Client – A downloadable software designed for taxpayers dealing in goods or both goods and services. The software supports multiple branches and pay points/cashier tills.

- Virtual Sales Control Unit (VSCU) – This solution enables seamless system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS, catering to taxpayers with extensive transactions or bulk invoicing.

- Online Sales Control Unit (OSCU) – This solution also facilitates system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is ideal for taxpayers using an online invoicing system.

Where do I install eTIMS?

eTIMS can be installed on either of the following devices:

- Windows based computers & laptops.

- Android smart phones, tablets & Personal Digital Assistant (PDA) devices.

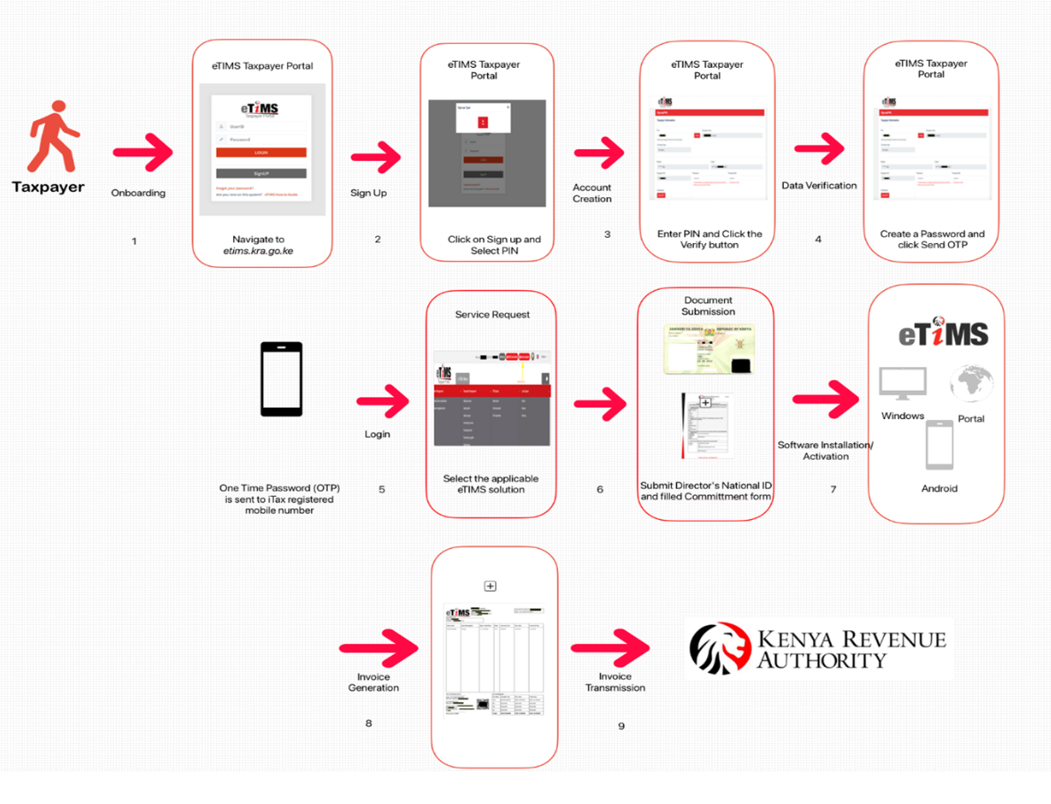

How to Onboard on eTIMS

Steps to follow:

- Sign up on the eTIMS Taxpayer Portal via etims.kra.go.ke

- Click on the Sign Up button and input your PIN.

- A One Time Password (OTP) will be sent to your iTax registered mobile number.

- Input the OTP sent to your iTax registered mobile number on the sign up page and you will be prompted to create a password for your profile to complete the sign up process.

- Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign up.

- Click on the Service Request button to select your preferred eTIMS software solution listed under the “eTIMS Type” menu

- Upload the following documents:

a. A copy of the National ID of:

-At least one of the Directors for companies

-At least one of the partners for partnerships

-The business owner for sole proprietorships

b. Duly filled in Commitment form – the form is accessible on the KRA website (click on Publications then click on eTIMS and search for the

eTIMS Acknowledgement & Commitment Form)

8. Submit your application to complete the onboarding process.

What happens after eTIMS on boarding & registration?

-

An authorized KRA officer will verify the application and approve as appropriate.

-

Install and configure the eTIMS software on the preferred device:

-For self-installation, one can access the “User guides” on the KRA website and “How to Videos” on the KRA You Tube channel

-Taxpayers can also visit the nearest KRA office for assistance.

Installation by Taxpayer’s Representatives

A taxpayer can appoint a suitable representative to sign up and install the eTIMS on their behalf. The following is required:

- An introductory letter, signed by at least one of the directors or partner or business owner clearly indicating who has been appointed as the tax representative and their role in the business. Include your contact information, in case a KRA official will need to get in touch with you.

- The director(s) or partner(s) or owner of the business should fill in and sign the eTIMS Acknowledgement & Commitment Form

- Copy of the director's/partner’s/owner’s National ID

- Copy of CR12 form for companies or Partnership Deed for Partnerships.

The above documents should be uploaded by the representative on the eTIMS portal.

eTIMS System to System Integration

This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS. This integration is possible via the Virtual Sales Control Unit (VSCU) or Online Sales Control Unit (OSCU).

-

Virtual Sales Control Unit (VSCU) – this solution allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers with numerous transactions/bulk invoicing.

-

Online Sales Control Unit (OSCU) - this solution also allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers using an online invoicing system.

Taxpayers can choose to initiate the self-integration process or enlist the services of KRA-verified third-party integrators, whose information is available on the KRA website.

The following links provide further information on self-integration, third party integrators and technical specifications:

- Visit the eTIMS portal.

- A step by step guide on how to sign upand technical Specification for the Trader Invoicing System (TIS) is also available for download.

Ready to Use and Install eTIMS?

Download and install eTIMS using any of the links below based on the device applicable to you.

- eTIMS Multi-Paypoint (Windows) Tooltip text

- eTIMS Paypoint (Windows).Tooltip text

- eTIMS Paypoint (Android).Tooltip text

- eTIMS Lite (VAT).Tooltip text

- eTIMS Lite (Non VAT). Tooltip text

- You can also access the Online portal.

Step by Step Guides for eTIMS

- eTIMS Online portal User guide

- eTIMS Paypoint User Guide (Android)

- eTIMS Lite (VAT) User Guide

- eTIMS Multi-Paypoint User Guide (Windows)

- eTIMS PayPoint User Guide (Windows)