One of the most contentious issues I have come across in the taxation discipline is the question of why a natural resource like water should be taxable. To set the record straight, any water that is not packaged, that is, tap water or water coming directly from a natural source does not attract any tax. However, once water is purified and bottled for sale, it becomes excisable. An excisable product is a product that attracts excise duty.

What is Excise Duty?

Excise duty is a tax imposed on goods and services manufactured in Kenya or imported into Kenya and specified in the first schedule of the Excise Duty Act (2015).

There are two key players in the water industry; bottlers and re-fillers. The biggest bone of contention has been with the latter category which specialises in refilling water using automatic water dispensers also known as ‘water ATMs’ on whether to charge excise duty or not. According to the law, they are also obligated to charge excise duty.

Following the recent tax amendments through the Finance Act 2020, all persons in the business of bottling (including through refilling) or packaging water are required to obtain an excise license from KRA as a prerequisite for charging and remitting excise duty.

Excise License

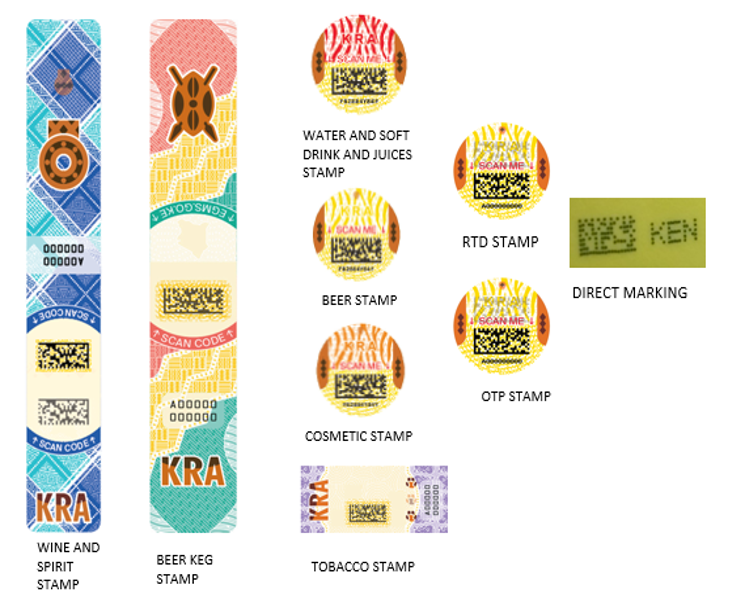

They are also required to affix excise stamps on each bottle that has been refilled or packaged. It is important to note that it is an offence to manufacture excisable goods without an excise license. It is also an offense to purchase, sell or be in possession of excisable goods that have been manufactured by unlicensed persons. Products from unlicensed manufacturers will either have counterfeit stamps or will not be affixed with any stamps at all.

Excise Stamps

KRA is the only agency mandated with the issuance of excise stamps. Excise stamps for water bottlers go for Kshs. 0.50 per stamp. As for the excise license, one can initiate the application process via iTax under the registration tab.

In situations where the sale of water is through automatic dispensers (water ATMs), it may be a challenge to affix stamps on the bottles of walk-in customers. In this case, the seller is required to obtain an excise license and remit to KRA Kshs. 5.47 for every litre of water sold per month.

It is important for those in the water business or those planning to venture into one to ensure they get the right information regarding the excise duty charged on water for compliance and to avoid inconveniences.

BLOG 22/09/2020