Simplicity, Convenience and Flexibility

What is eTIMS?

eTIMS (electronic Tax Invoice Management System) is a software solution that provides taxpayers with options for a simple, convenient and flexible approach to electronic invoicing.

Taxpayers can access eTIMS on various computing devices, including computers, laptops, tablets, smartphones, and Personal Digital Assistants (PDAs).

Who should use eTIMS?

All persons engaged in business are required to on-board eTIMS and issue electronic tax invoices.

Why is it not just for VAT registered taxpayers?

The law requires that for any person to claim their business expense, the expense must be supported by an electronic tax invoice. Therefore, all persons engaged in business are required to issue electronic tax invoices, whether registered for VAT or not (non-VAT taxpayers).

Why eTIMS?

-

It aids in reducing compliance costs as the solutions are provided free of charge;

-

eTIMS offers flexibility in the solutions available and is accessible on various computing devices;

-

The stock management module assists taxpayers maintain their own inventory;

-

eTIMS allows taxpayers to a maintain record of invoices issued on the taxpayer portal;

-

eTIMS facilitates simplified return filing for taxpayers.

What are the solutions available on eTIMS?

The solutions available include:

- Online Portal- Tailored for taxpayers in the service sector exclusively, where no goods are supplied.

- eTIMS Client – A downloadable software designed for taxpayers dealing in goods or both goods and services. The software supports multiple branches and pay points/cashier tills.

- Virtual Sales Control Unit (VSCU) – This solution enables seamless system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS, catering to taxpayers with extensive transactions or bulk invoicing.

- Online Sales Control Unit (OSCU) – This solution also facilitates system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is ideal for taxpayers using an online invoicing system.

Where do I install eTIMS?

eTIMS can be installed on either of the following devices:

- Windows based computers & laptops.

- Android smart phones, tablets & Personal Digital Assistant (PDA) devices.

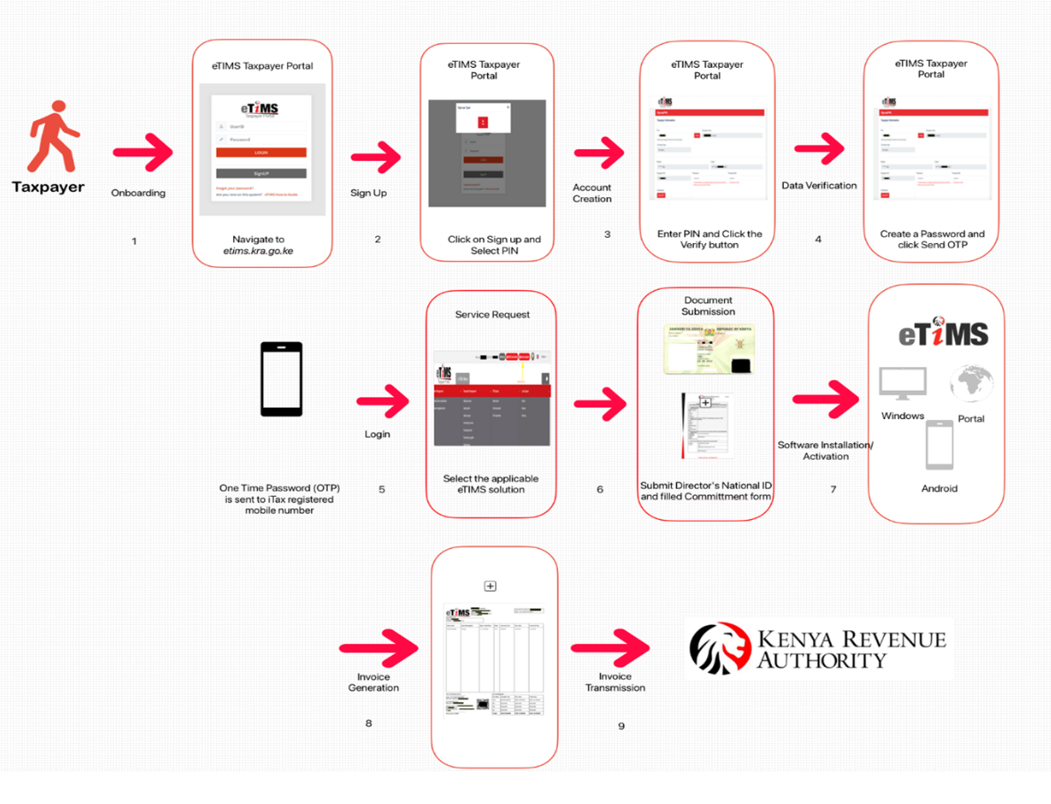

How to Onboard on eTIMS

Steps to follow:

- Sign up on the eTIMS Taxpayer Portal via etims.kra.go.ke

- Click on the Sign Up button and input your PIN.

- A One Time Password (OTP) will be sent to your iTax registered mobile number.

- Input the OTP sent to your iTax registered mobile number on the sign up page and you will be prompted to create a password for your profile to complete the sign up process.

- Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign up.

- Click on the Service Request button to select your preferred eTIMS software solution listed under the “eTIMS Type” menu

- Upload the following documents:

a. A copy of the National ID of:

-At least one of the Directors for companies

-At least one of the partners for partnerships

-The business owner for sole proprietorships

b. Duly filled in Commitment form – the form is accessible on the KRA website (click on Publications then click on eTIMS and search for the

eTIMS Acknowledgement & Commitment Form)

8. Submit your application to complete the onboarding process.

What happens after eTIMS on boarding & registration?

-

An authorized KRA officer will verify the application and approve as appropriate.

-

Install and configure the eTIMS software on the preferred device:

-For self-installation, one can access the “User guides” on the KRA website and “How to Videos” on the KRA You Tube channel

-Taxpayers can also visit the nearest KRA office for assistance.

Installation by Taxpayer’s Representatives

A taxpayer can appoint a suitable representative to sign up and install the eTIMS on their behalf. The following is required:

- An introductory letter, signed by at least one of the directors or partner or business owner clearly indicating who has been appointed as the tax representative and their role in the business. Include your contact information, in case a KRA official will need to get in touch with you.

- The director(s) or partner(s) or owner of the business should fill in and sign the eTIMS Acknowledgement & Commitment Form

- Copy of the director's/partner’s/owner’s National ID

- Copy of CR12 form for companies or Partnership Deed for Partnerships.

The above documents should be uploaded by the representative on the eTIMS portal.

eTIMS System to System Integration

This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS. This integration is possible via the Virtual Sales Control Unit (VSCU) or Online Sales Control Unit (OSCU).

-

Virtual Sales Control Unit (VSCU) – this solution allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers with numerous transactions/bulk invoicing.

-

Online Sales Control Unit (OSCU) - this solution also allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers using an online invoicing system.

Taxpayers can choose to initiate the self-integration process or enlist the services of KRA-verified third-party integrators, whose information is available on the KRA website.

The following links provide further information on self-integration, third party integrators and technical specifications:

- Visit the eTIMS portal.

- A step by step guide on how to sign upand technical Specification for the Trader Invoicing System (TIS) is also available for download.

Ready to Use and Install eTIMS?

Download and install eTIMS using any of the links below based on the device applicable to you.

- eTIMS Multi-Paypoint (Windows) Tooltip text

- eTIMS Paypoint (Windows).Tooltip text

- eTIMS Paypoint (Android).Tooltip text

- eTIMS Lite (VAT).Tooltip text

- eTIMS Lite (Non VAT). Tooltip text

- You can also access the Online portal.

Step by Step Guides for eTIMS

- eTIMS Online portal User guide

- eTIMS Paypoint User Guide (Android)

- eTIMS Lite (VAT) User Guide

- eTIMS Multi-Paypoint User Guide (Windows)

- eTIMS PayPoint User Guide (Windows)